a shock is ahead for the housing market

The message from the Federal Reserve is pretty clear. Through April 2023 they predict a gradual deceleration in annual home value growth from the current rate of 209 percent to 116 percent.

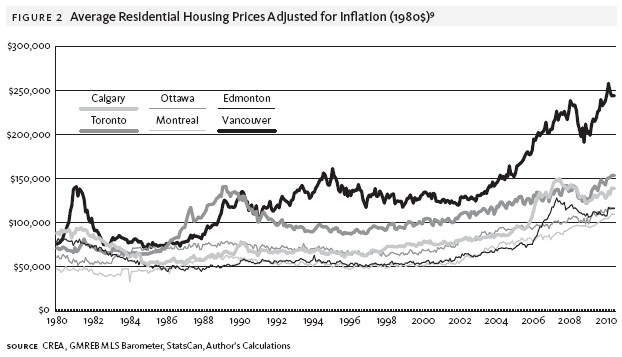

Canadian Real Estate Doesn T Have A Supply Problem It S A Demand Issue Bmo Better Dwelling

A borrower who took on a 500000.

. Bond-tapering and Fed rate hikes started on March 16 2022. Us Median Home Price Outlook Upward Housing Market Real Estate House Prices 2016 Year In Review Bubbles Bubble Chart Housing Market Credit Growth In The Australian Home Loan Market Smash Australian Homes Roof. After all just look at what its doing to mortgage payments.

A shock is headed for the housing market. More than 7 million American homeowners were enrolled in the mortgage forbearance program at the height of the pandemic. The red-hot US housing market may finally be cooling off the economist Ian Shepherdson says.

2022 Housing Prediction 5. Zillows housing market forecast has been revised from April. Meanwhile house prices are high.

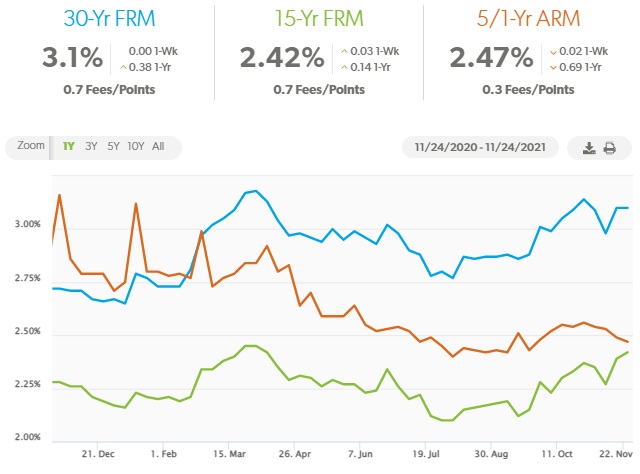

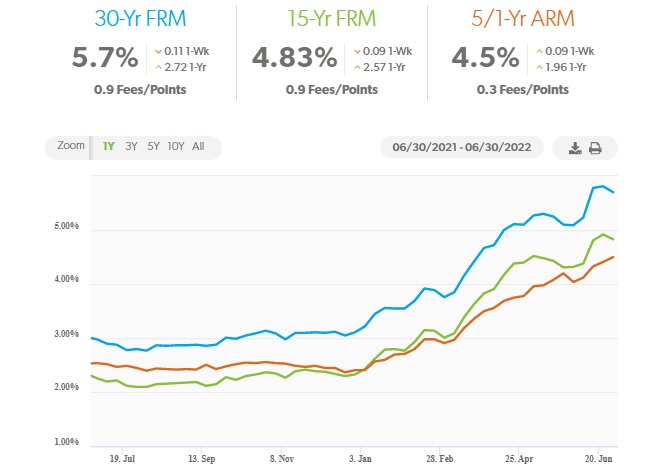

The real estate group now forecasts 116 home value growth over the next 12 months May 2022-April 2023. As of April 13th 2022 the 30-year fixed-rate mortgage hit 5 for the first time since 2011. Mortgage rates will be over 6.

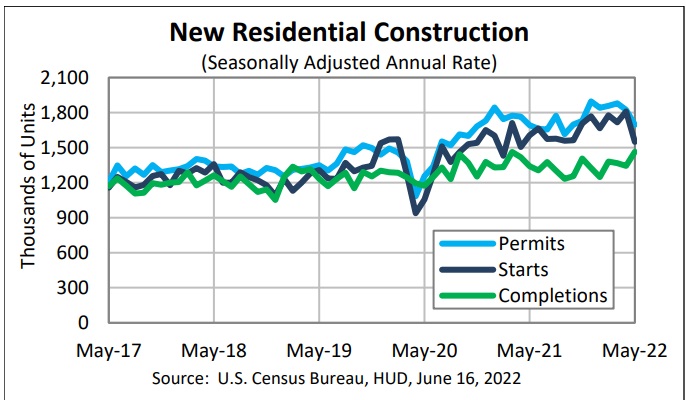

Experts are still seeing a post-pandemic reboundwere talking steady mortgage rates job recoveries and the law of supply and demand all working together to make home sales go kaboom. From year-end 2021 to today the double whammy of rising home prices and. The housing market exploded like fireworks last yearand many of those sparks may continue flying in 2022.

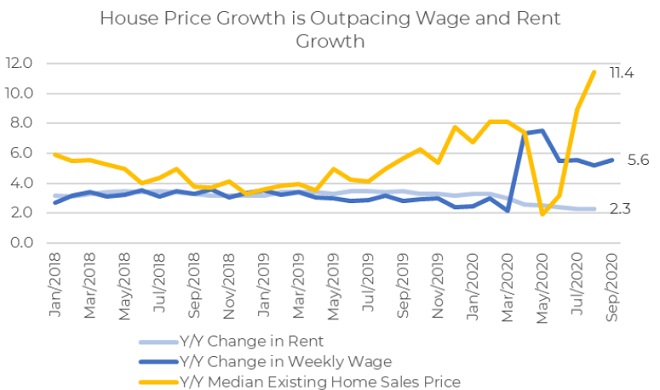

Home prices spiked by 259 in Phoenix 247 in San Diego and 234 in Seattle according to the report. Affordability is becoming an issue. And thats making housing seem relatively affordable by historical standards As for the low supply of available homes that was a problem even before the pandemic began and there are no quick fixes to alleviate the shortage the economists write.

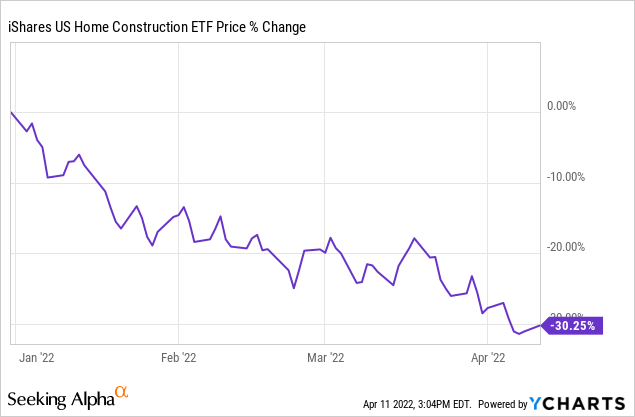

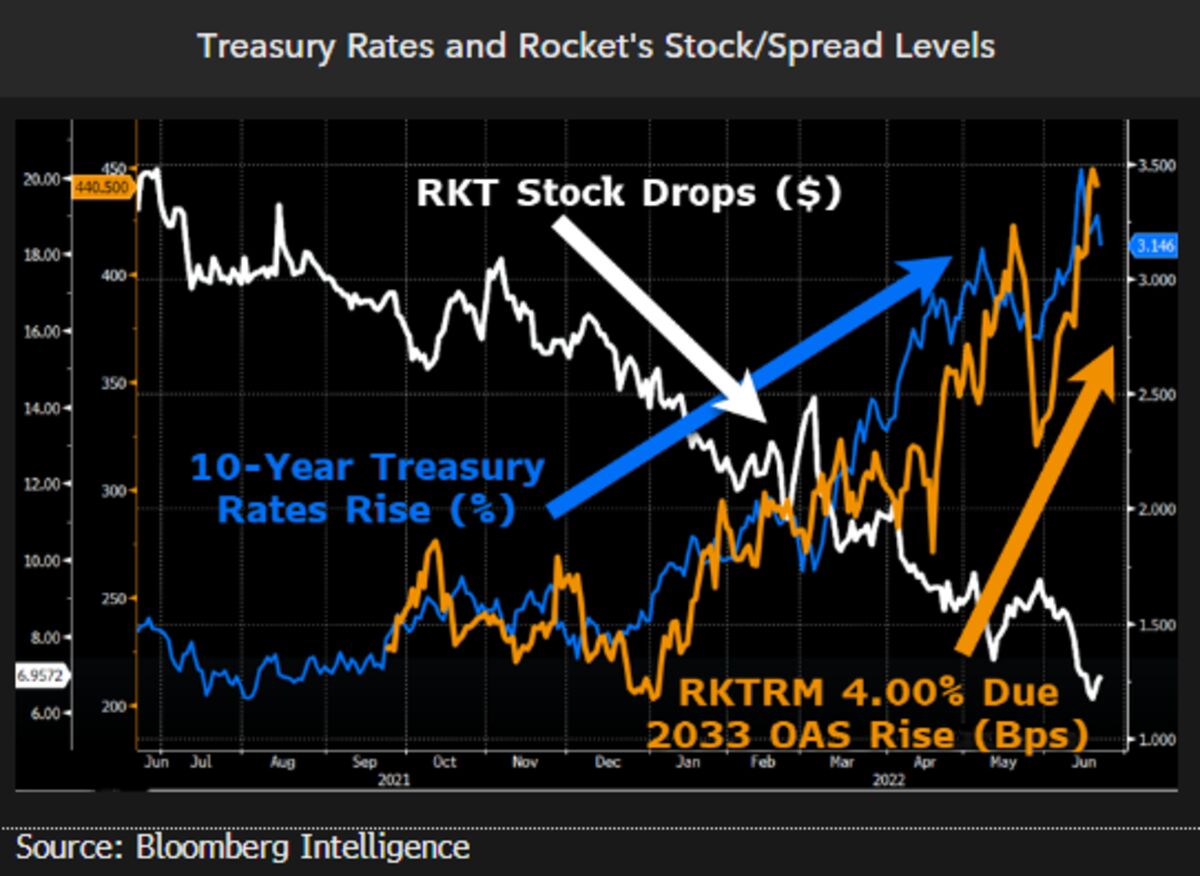

Industry insiders tell Fortune this swift move up in mortgage rates amounts to an economic shock. This pace of double-digit price appreciation in the housing market is unsustainable. As a result there are more.

But if a borrower got that loan at a 5 rate that payment would. Nationwide house prices appear overvalued by approximately. Thats a bigger deal than it might first appear.

A shock is ahead for the housing market Sunday March 13 2022 Edit. Consider the housing crash in 2007. The latest Zonda data shows the average new-home base price sits at 697135 which is 44 higher than two years ago.

April 13 2022 1256 AM 3 min read. The presentation featured a panel of industry veterans who discussed how to think ahead to and prepare for this development what macro-economic factors will influence the 2021 housing market. The economic shock hitting the housing market is starting to do some damage.

Housing Market Faces A Shock Ahead Pandemic policies have surely shaped the way the US. Instead I think home prices will rise by closer to 8 in 2022 not 16 like it did in 2021. At the height of the pandemic more than 72 million homeowners were in the mortgage forbearance program which allows some borrowers to pause their.

But stress lines are beginning to show in the housing market. The 10-year ARM adjustable rate mortgage was at 43. Historically real estate has proven very resilient with median home prices declining in just eight of the past 60 years.

Home prices have risen so far so fast that they have become overvalued. At a 311 rate a borrower would owe 1710 per month on a 400000 mortgage. You can see.

There may be some sticker shock at home prices but mortgage rates are actually quite low. Supply versus demand. Housing market has functioned.

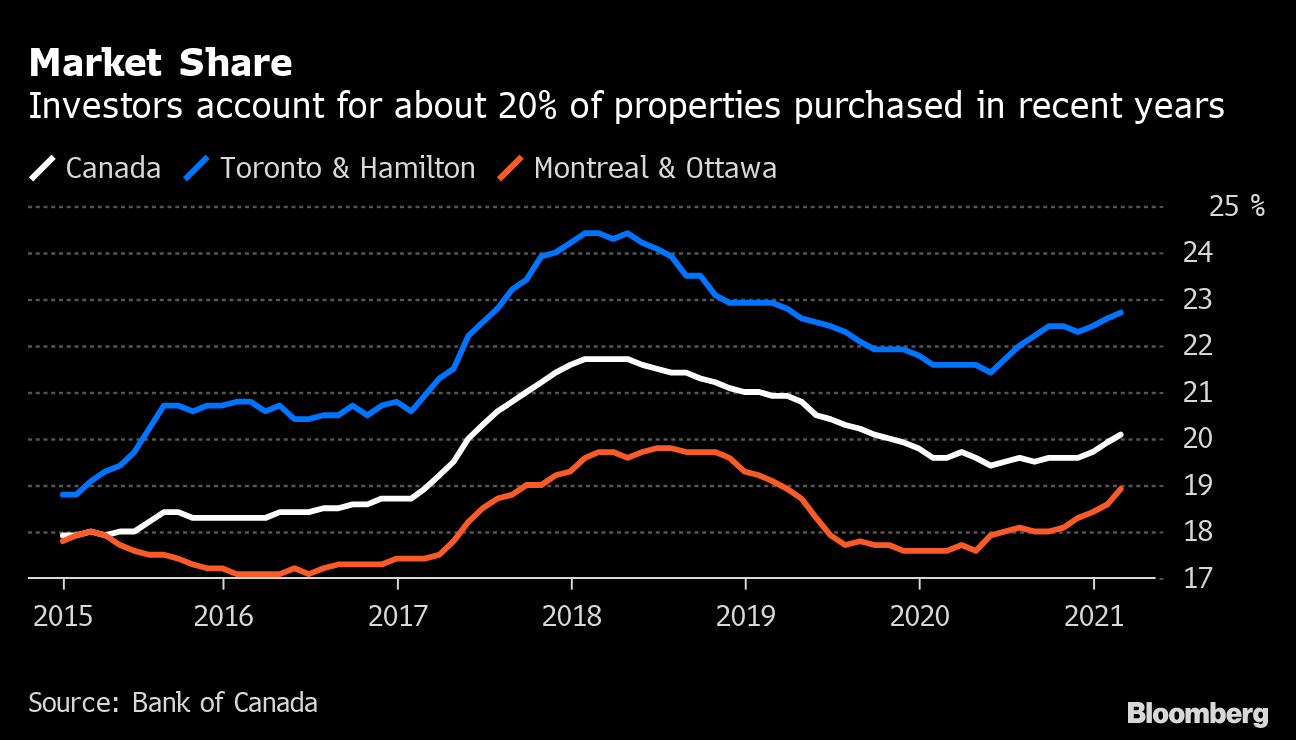

Meanwhile existing home prices continued to. A shock is ahead for the housing market Friday June 24 2022 Edit Mortgage rates rose the number of home sales fell and prices continued to climb in the first quarter of the year but economists foresee the hot and frenzied housing market finally cooling for the remainder of. A financial shock is coming for those who jumped into the housing market during the COVID-19 pandemic Rob Carrick Personal Finance Columnist Published June 29 2021 Updated June 30 2021.

In recent notes the Pantheon Macroeconomics founder laid out data pointing to a market slowdown.

Real Estate Housing Market Crash Housing Bubble Factors Signals Predictions

Real Estate Housing Market Crash Housing Bubble Factors Signals Predictions

Housing Market Disquiet Grows With Price Data Mortgage Tremors Bloomberg

Report Will The Canadian Housing Market Crash In 2021 Lowestrates Ca

California Housing Crash Searches Surge

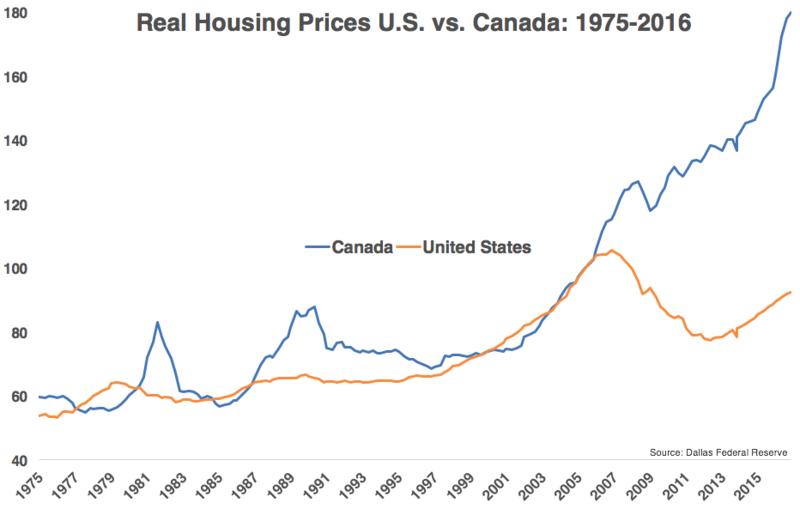

Forget About The United States The Real Housing Bubble Is In Canada Seeking Alpha

Is The Housing Market Rolling Over

Canadian Housing Another Debt Fueled Bubble Seeking Alpha

Canada S Housing Market Gone Berserk Stirs Unease Over Investors Clout Bloomberg

A Clear Warning Signal For The Housing Market Seeking Alpha

A Shock Is Headed For The Housing Market

The Unassuming Economist Housing View July 1 2022

Why Despite The Coronavirus Pandemic House Prices Continue To Rise The Economist

Real Estate Housing Market Crash Housing Bubble Factors Signals Predictions

Housing Market Disquiet Grows With Price Data Mortgage Tremors Bloomberg

Robert Shiller Says The Housing Market Will Crash No One Else Seems To Think So Seeking Alpha

Canadian Real Estate Could Be In For A Correction Or Worse Bmo Better Dwelling

How Likely Is A Real Estate Market Crash The Motley Fool

Real Estate Housing Market Crash Housing Bubble Factors Signals Predictions